Problem

Saving money is difficult, especially in the long term. Maintaining excellent habits and staying consistent on the path to saving objectives seems to be the most difficult.

Solution

Providing the ability to save money without attracting the user's attention, but with the possibility of full control over the saving process.

What is this

Hooties is a money-saving app project that allows users to choose or combine one or more of four different ways to save money.

Bussiness model

Creating revenue through consistent fees from each saving period. Making money from premium users. A Premium account, among others, allows users to set multiple saving goals at the same time.

What is this

Hooties is the project of money saving application that allows users to pick or merge one or more of four available ways of saving money.

Rounding

Every amount paid by card is rounded up to the nearest €1, €2 or €5 and the change is applied to the savings.

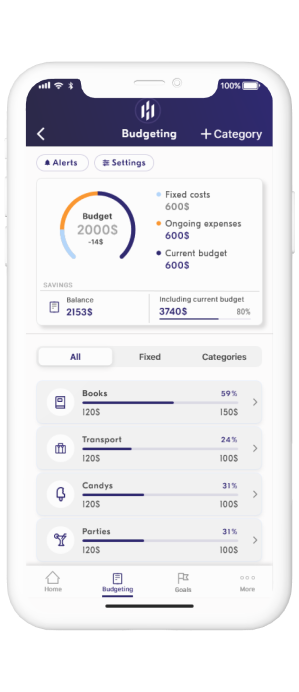

Budgeting

A user can set the amount he declares as the sum of all his small expenses that he expects to spend in the previously set period of time. Both the definition of small expenses and the time period are declared by the user. The difference between declared and spent amounts applies to the savings.

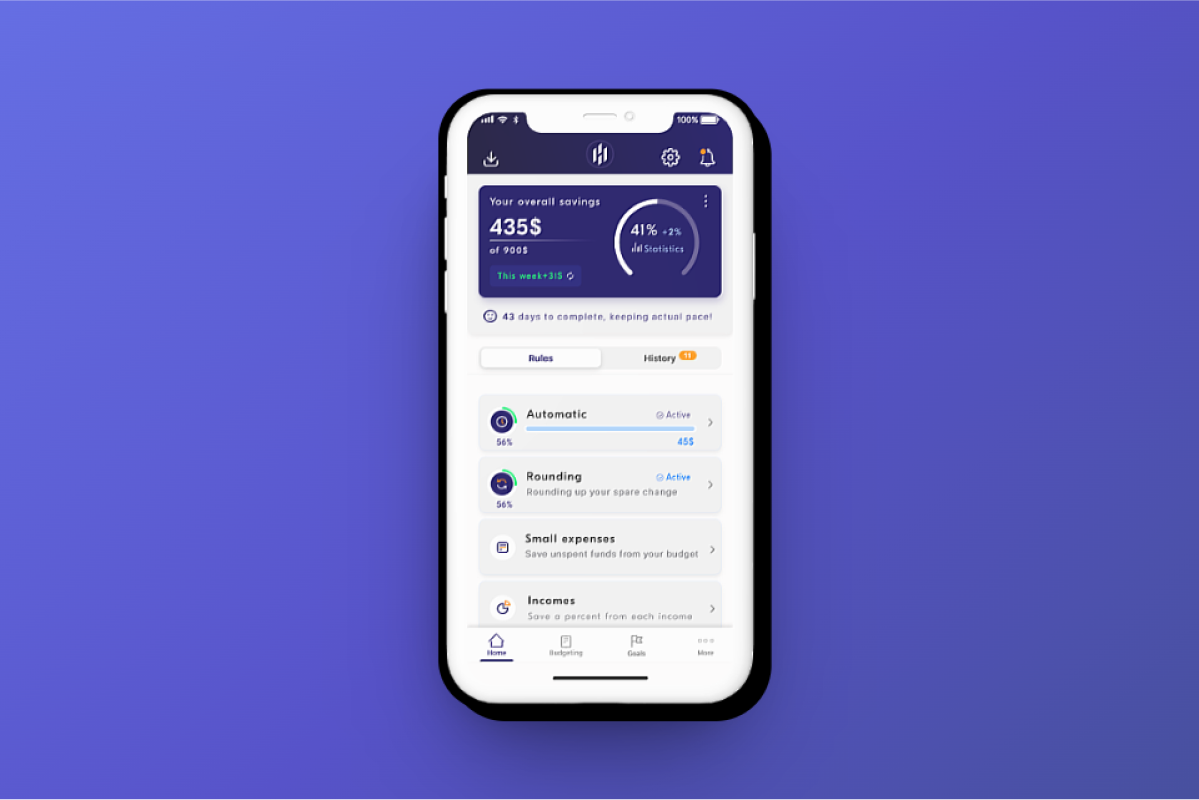

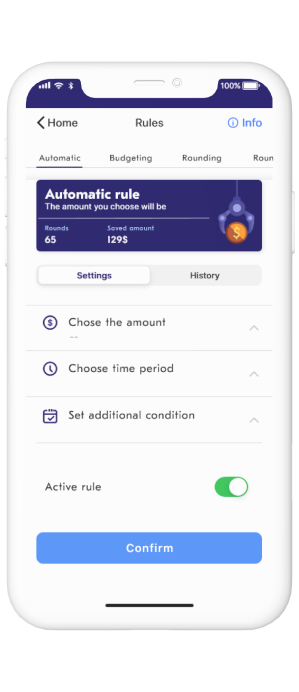

Automatic

The predetermined by the user amount is cyclically transferred to the savings. The time period and frequency are settled by the user.

Rules

Each rule has a separate configuration window. The tab at the top allows you to switch between rules and options. The main tab contains the most important information about the effectiveness of a given rule. Under the "History" tab, detailed information about the activity, amounts saved and dates is available.

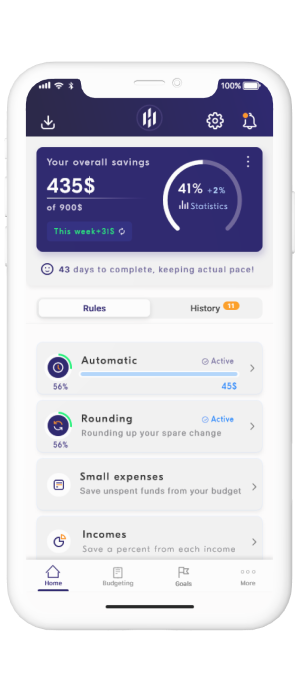

Saving goals

To start the saving process, the user enters the amount he wants to save and sets the time frame for the saving round. After entering basic data, the user can choose which way of saving money suits him the most. Saving methods can be combined with each other or be suspended at any time. The user has access to these functions directly from the dashboard. Equally important is the option of freezing the saved amount until the intended amount is reached, or the current saving round is completed.

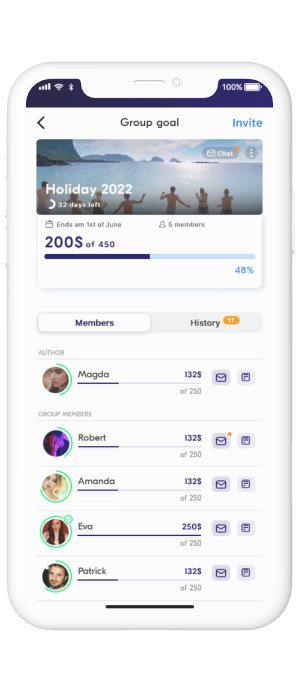

Group savings

The application allows the user to set a common saving goal for a group of people. The saving processes are the same as for individual saving, but the saving goal and amount are common for every member of the group. The user can track the progress and each user's contribution to the common goal. Users can send messages to each other and use "the poke" function to remind other members of their obligations to the group.

Budgeting tool

The budgeting tool is the only one which occasionally demands users' attention. After finishing the billing period, the user is asked if he wants to save the unspent difference, or adjust the amount to his preferences. The reason for this is-the difference might vary in different billing periods and sometimes can surpass significantly users' expectations. In addition to the available savings tools, the user is able to send money to his saving account by himself. Because for safety reasons, the process demands SMS verification. According to the research I conducted, the budgeting functionality is unique and not present in other applications of this type.